CHICAGO – February 21, 2024 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the fourth quarter and full year ended December 31, 2023.

Highlights:

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

Management Commentary

Eddie Lehner, Ryerson’s President and Chief Executive Officer, said, “Reflecting on the fourth quarter, and full-year 2023, I want to start by thanking my Ryerson teammates for prioritizing operating safely throughout our entire organization as safety is always our first priority. As far as our over-all business performance, 2023 marked the second year of Ryerson’s longest and most significant investment cycle in more than a generation. We are taking big steps to create our next-generation operating model and the industry’s best customer experience. Over the past year, we invested in the modernization, integration and expansion of our network of interconnected intelligent service centers, highlighted by an Enterprise Resource Planning (“ERP”) conversion across our largest business unit, new and expanding facilities at Centralia, WA, University Park, IL, Las Vegas, NV, and Shelbyville, KY, as well as welcoming four excellent additions to the Family of Companies in BLP Holdings, LLC, Norlen Incorporated, TSA Processing, and Hudson Tool Steel Corporation. We finished the year with approximately two-thirds of our operating cash flow allocated to growth-oriented projects while increasing our dividend over four consecutive quarters and buying back approximately $114 million of Ryerson shares for the full-year.

Over the fourth quarter and the entire year, as we carried out our investments in modernization, integration, and expansion, our business operated against a backdrop of slowing manufacturing activity. You could say the sun wasn’t shining on our addressable markets as full-year industry stainless volumes corrected down 14% and nickel traded down by more than 40%, while other industrial metal-consuming verticals to which we have less exposure performed better, such as automotive, aerospace, defense and non-residential construction. Fourth quarter volumes decreased across most of our end-markets due to holiday seasonality and ongoing destocking across non-ferrous product lines. For the full-year 2023, our end-market volumes mainly increased in our commercial ground transportation and oil & gas end-markets, while decreasing across most other industrial and consumer end-markets. Despite moving through a counter-cyclical bottom across the majority of our commercial book of business, we continue to believe that our aforementioned investments in our next-gen operating model will position us to deliver higher thru-the-cycle earnings to our shareholders with less volatility as we inflect to an anticipated industry upturn as well as expected longer-term secular growth drivers in North American manufacturing.”

Fourth Quarter Results

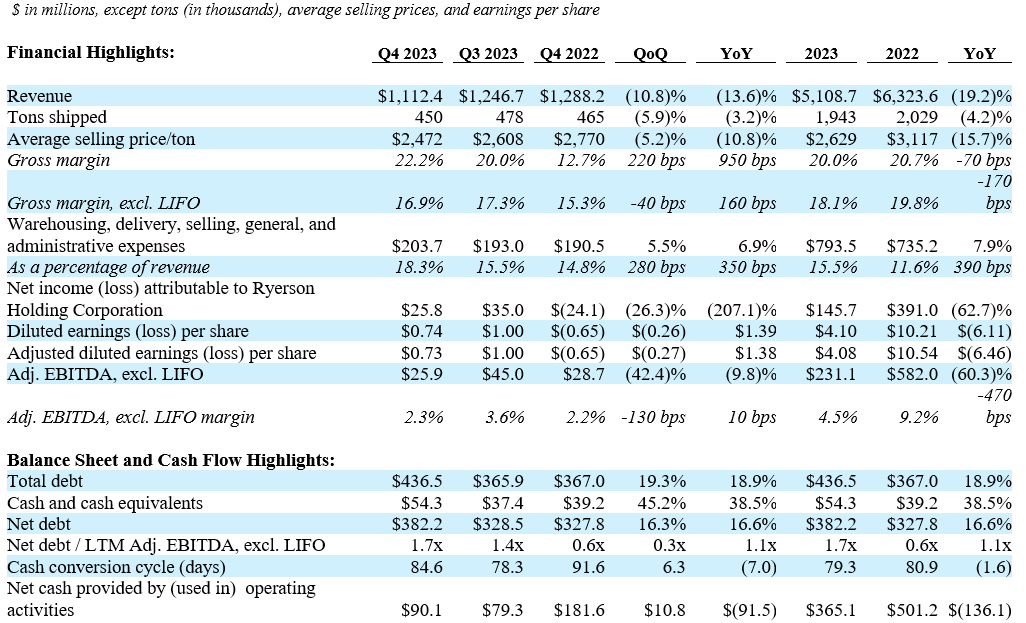

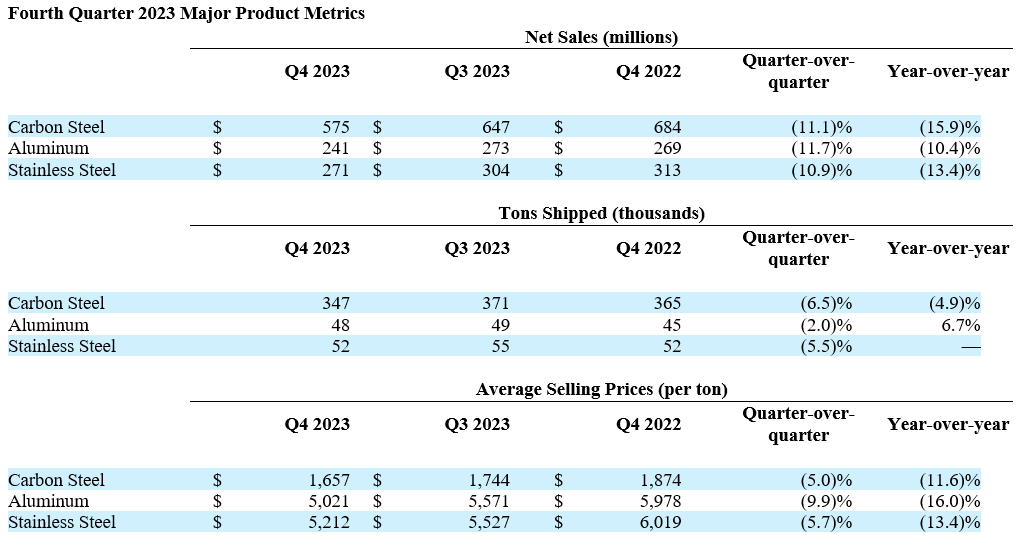

Ryerson generated revenue of $1.1 billion in the fourth quarter of 2023, a decrease of 10.8% compared to the third quarter of 2023. Revenue during the period was influenced by seasonally lower volumes and easing average selling prices, which decreased 5.9% to 450,000 tons and 5.2% to $2,472 per ton, respectively, compared to the third quarter of 2023.

Gross margin expanded sequentially by 220 basis points to 22.2% in the fourth quarter of 2023, compared to 20.0% in the third quarter. Gross margins reflected LIFO income of $59.3 million, as average inventory costs were impacted by decreases in commodity price for our metals products sales mix. Excluding the impact of LIFO, gross margin contracted 40 basis points to 16.9% in the fourth quarter of 2023, compared to 17.3% in the third quarter. The compression in gross margins, excluding LIFO, was primarily driven by a decrease in prices of our aluminum and stainless-steel product mix due to above normal inventories in the channel that put downward pressure on average selling prices.

Warehousing, delivery, selling, general and administrative expenses increased 5.5% to $203.7 million in the fourth quarter, compared to $193.0 million in the third quarter, primarily driven by higher depreciation expense, increased operating expenses from recent acquisitions, as well as reorganization expenses related to our ERP system conversion and start-up costs associated with the University Park, Illinois service center, partially offset by lower personnel-related expenses, lower delivery expenses, and lower fixed and variable operating expenses.

Net income attributable to Ryerson Holding Corporation for the fourth quarter of 2023 was $25.8 million, or $0.74 per diluted share, compared to net income of $35.0 million, or $1.00 per diluted share in the previous quarter. Ryerson generated Adjusted EBITDA, excluding LIFO of $25.9 million in the fourth quarter of 2023, compared to the third quarter Adjusted EBITDA, excluding LIFO of $45.0 million. For the full-year 2023, Ryerson generated $5.1 billion in revenue and earned $145.7 million in net income and $231.1 million in Adjusted EBITDA, excluding LIFO.

Liquidity & Debt Management

Ryerson generated $90.1 million of cash from operations in the fourth quarter of 2023, supported by net income attributable to Ryerson Holding of $25.8 million and working capital release of $15.1 million. The Company ended the fourth quarter of 2023 with $436.5 million of debt and $382.2 million of net debt, an increase of $69.5 million and $54.4 million, respectively, compared to the fourth quarter of 2022. Ryerson’s leverage ratio as of the fourth quarter was 1.7x, which remains within the Company’s target leverage range. Ryerson’s global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, was $656 million as of December 31, 2023.

Shareholder Return Activity

Dividends. On February 21, 2024, the Board of Directors declared a quarterly cash dividend of $0.1875 per share of common stock, payable on March 21, 2024, to stockholders of record as of March 7, 2024. During the fourth quarter of 2023, Ryerson paid a quarterly dividend in the amount of $0.1850 per share, amounting to a cash return of approximately $6.3 million. For the full-year 2023, Ryerson paid dividends of approximately $0.72 per share, which resulted in a return of $24.8 million to shareholders.

Share Repurchase. Ryerson repurchased 219,614 shares for $6.3 million in the open market during the fourth quarter of 2023. Ryerson made these repurchases in accordance with its share repurchase authorization, which allows the Company to acquire up to an aggregate amount of $100.0 million of the Company’s common stock through April of 2025. For the full-year 2023, the Company repurchased 3.3 million shares, resulting in a return of $113.9 million to shareholders. As of December 31, 2023, $39.4 million of the $100.0 million remained under the existing share repurchase authorization.

Outlook Commentary

For the first quarter of 2024, Ryerson expects normal seasonal demand conditions, with customer shipments expected to increase approximately 8% to 10%, quarter-over-quarter. The Company anticipates first-quarter revenue to be in the range of $1.21 to $1.25 billion, with average selling prices increasing 1% to 3%. LIFO income in the first quarter of 2024 is expected to be zero. We expect Adjusted EBITDA, excluding LIFO in the range of $58 million to $62 million and earnings per diluted share in the range of $0.24 to $0.34.

Earnings Call Information

Ryerson will host a conference call to discuss fourth quarter and full-year 2023 financial results for the period ended December 31, 2023, on Thursday, February 22, 2024, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,600 employees and 114 locations. Visit Ryerson at www.ryerson.com.

Manager - Investor Relations:

Pratham Dear, Manager - Investor Relations

312.292.5033

Notes:

1For EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding LIFO please see Schedule 2

2Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit, and is not soliciting, any action with respect to any Security or any other contractual relationship with Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to U.S. persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent our annual report on Form 10-K and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

For full release details see ir.ryerson.com.